This feature has been widely adopted by news organizations and content creators as an effective way to reach their target audience directly. – 텔레그램 자동 발송 프로그램

Car Maintenance: Tips for Keeping Your Vehicle in Top Shape

The brake system is critical for your safety on the road. Proper brake maintenance ensures effective stopping power 내차팔기 and prevents accidents. Here’s what you should know about brake system maintenance:

How to Know If You Are Dating a Millionaire

Millionaires are wealthy men, who have the ability to spend on both you and your loved ones. The standards of dressing have changed, but that doesn’t mean you need to be price easy. 강남사라있네, Wear nice clothing that has boastven benefits.

The Power of Online Marketing: Strategies for Success in the Digital Age

Unlike traditional forms of advertising such as television or print media, online marketing allows businesses to target specific audiences based on demographics, interests, and behaviors. 전자담배 액상 사이트 순위

커플 마사지: 서로를 사랑하는 커플을 위한 완벽한 휴식 시간

1. 소개 커플 마사지는 로맨틱하고 독특한 경험을 제공하는 마사지 형태입니다. 이는 커플들이 함께 휴식하고 동시에 서로에게 애정을 표현하는 좋은 방법입니다. 커플 마사지는 몸과 마음을 편안하게

로또 디비 5 Tips for Successful Online Marketing Strategies

Once you’ve identified your target audience, 효율적인 로또 디비 길잡이 db-buysell.com create content and campaigns that appeal directly to them.

Female Sexual Dysfunction

For the sake of your own peace of mind and peace of worry, 비아마켓.com it is good to know what this disorder is all about so that you can have a better understanding of the causes and possible solutions.

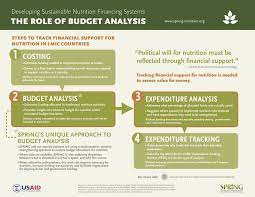

Improve Nutrition on a Budget

Improve Nutrition on a Budget : You don’t need to break the bank to lose weight and be healthy. There are so many delicious healthy low cost ideas that will leave your heart, and your wallet, happy. 메틸코발라민 효능

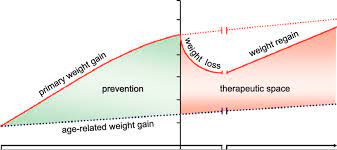

A Natural History of Obesity

A Natural History of Obesity : www.pharmacyviagra.com The way we see what we eat says a lot about who we are and the esteem in which we hold ourselves.

Forex Trading System – Trading Made Easy

The values of these currencies are continually changing due to their country’s minus percentage in terms of stock values, their withstanding in the market, as well as, their various factorizations. 핸드폰 소액결제 현금화 The goal of forex traders is to profit from the buying and selling of currencies across the world.

deep sleep meditation Christian Meditation: Finding out about God’s Word and also Following It

the fantastic things you need to do to profit other people as well as assist individuals who can’t assist themselves, you will be making a good idea for society. deep sleep meditation

메이저놀이터 Sports Betting Line

It likewise signals you what the chances of winning are for each group, the more than as well as under on point overalls, as well as how much you need to bet for you to get a certain payback. 메이저놀이터

Long-lasting vs. temporary assets assets

Assets financial investment will certainly supply a lot of wonderful options however can easily be ruining for a quick condition financier. 바이비트 거래소

Student Checking Account

. Fees for transfers according to the months 1, 3, and 12 are $3.50 USD. For example the cost for a month of two day’s worth of Internet ATM access is $6.50. There will be no transaction fee for this transaction 성범죄 전문 법무법인

Ranking in the Google

factors in making your site a good match for Google, and putting you in the top 10 of the Google search results: 비아그라 퀵 배송

먹튀검증 Omaha Casino Poker Basics: Tips For Knowing To Conform

The supplier right now considers another neighborhood panel memory card experience atop the dining table. This aspect of the texas hold’em activity is called the turn. The turn represents memory card variety 8. 먹튀검증

How to Get Out of Debt

you need to change the way that you view money and credit. You can help this situation quite easily, and the best part is that it’s very straightforward to do. 형사전문 변호사

스포츠 중계 XM Broadcast Details

In purchase to utilize the XM Radio computer programming, you require an XM Radio recipient, a registration, and also an aerial to the XM companies. 스포츠 중계

Futures Trading Platform

As per the trends and opportunities, it also provides you a platform for converting assets easily. 상속재산 분할심판 청구